To create a new email address, visit your chosen email service provider’s website and follow their sign-up process. Fill in the required information and complete the verification steps.

Creating a new email address is essential for personal and professional communication. It allows you to stay connected, manage your online accounts, and receive important updates. Popular email service providers like Gmail, Yahoo, and Outlook offer user-friendly interfaces and robust security features.

Setting up an email account is straightforward and usually free. You will need to provide some basic information, such as your name, desired email address, and password. A verification step ensures your identity and enhances security. With a new email address, you can start organizing your digital correspondence efficiently.

Introduction To Email Creation

Creating a new email address is simple and quick. An email address helps you communicate. It is also essential for online services.

Let’s explore the importance of having a reliable email. We will also see why having multiple email accounts is useful.

The Importance Of A Reliable Email Address

A reliable email address is essential. It ensures you do not miss important messages. Reliable emails have strong security to protect your information.

Many services require an email address. This includes social media, banking, and shopping sites. A good email address is key for these activities.

Common Uses For Multiple Email Accounts

Multiple email accounts can be very useful. They help you organize your life better. Here are some common uses:

- Work: Keep work emails separate from personal ones.

- Personal: Use one email for friends and family.

- Shopping: Have a separate email for online shopping.

- Subscriptions: Use another email for newsletters and updates.

Having different emails helps you manage spam better. It also makes it easier to find important messages.

Choosing The Right Email Service Provider

Creating a new email address starts with choosing the right provider. The choice can impact your email experience. Let’s explore the best options and what to consider.

Popular Email Services

Many email services are available. Here are some of the most popular ones:

- Gmail: Offers 15GB of free storage and integrates with Google services.

- Outlook: Provides seamless integration with Microsoft Office tools.

- Yahoo Mail: Comes with 1TB of free storage and a user-friendly interface.

- ProtonMail: Focuses on privacy and offers end-to-end encryption.

Factors To Consider

Not all email services are created equal. Here are key factors to consider:

- Storage: Check how much storage is available for free.

- Security: Look for services with strong security features.

- Ease of Use: Choose an easy-to-use and navigate interface.

- Compatibility: Ensure it works well with other tools you use.

- Support: Consider if customer support is available and helpful.

| Service | Free Storage | Special Features |

|---|---|---|

| Gmail | 15GB | Google Drive integration |

| Outlook | 15GB | Office tools integration |

| Yahoo Mail | 1TB | Large storage capacity |

| ProtonMail | 500MB | End-to-end encryption |

Choosing the right email provider is important. It ensures a smooth email experience. Take your time and choose wisely.

Setting Up Your New Email Account

Creating a new email account is easy. Follow the steps below to get started. This guide will help you create and verify your new email address.

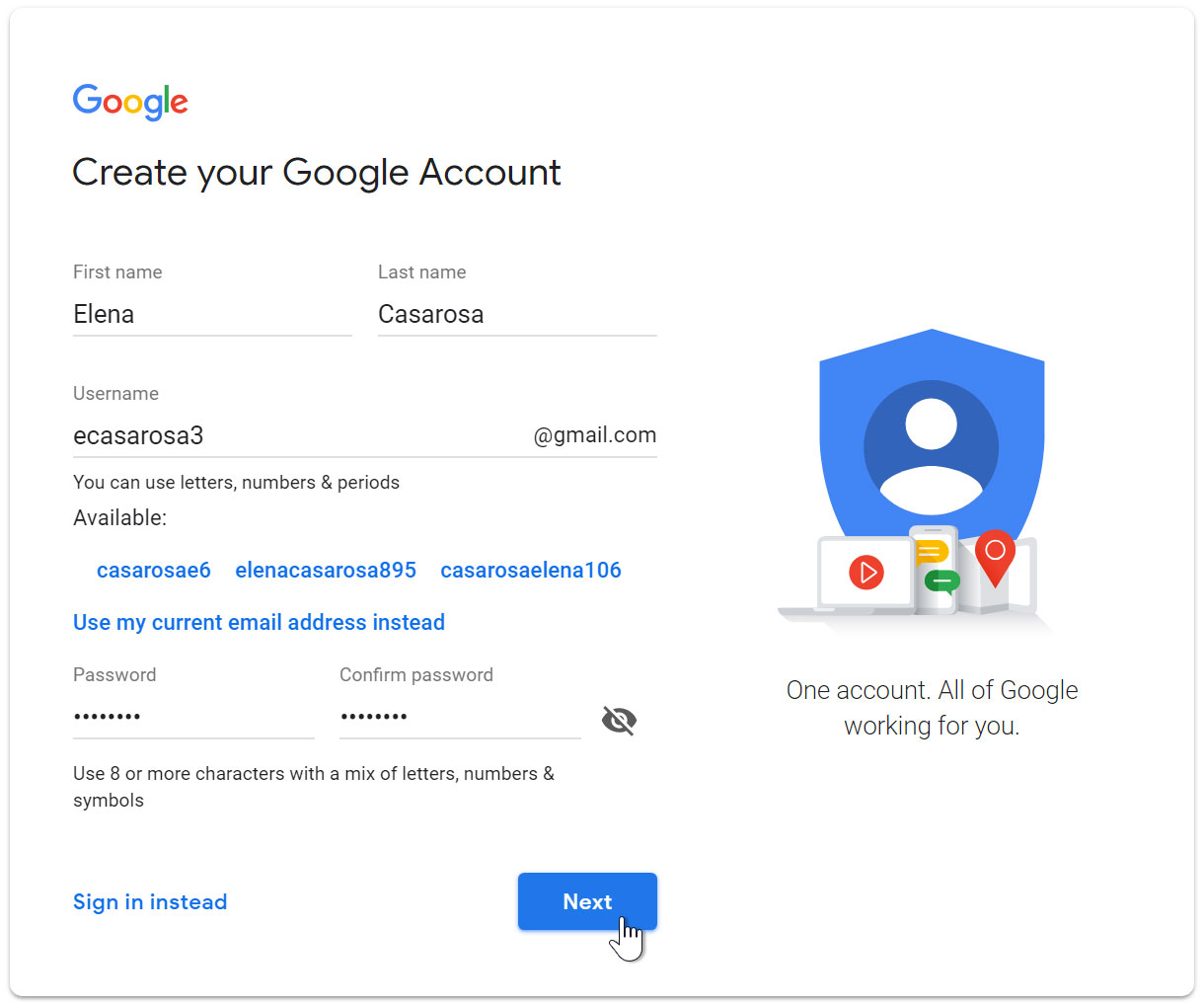

Step-by-step Account Creation

Follow these simple steps to create your new email account:

- Go to your chosen email provider’s website.

- Click on the “Sign Up” or “Create Account” button.

- Enter your personal information in the required fields.

- Choose a unique username for your email address.

- Create a strong password for your account.

- Provide a backup email or phone number for security.

- Agree to the terms and conditions.

- Click the “Submit” or “Next” button to proceed.

Verifying Your New Email

After creating your account, you must verify your email:

- Check your inbox for a verification email.

- Open the email and find the verification link.

- Click the verification link to confirm your account.

- If asked, enter the verification code provided in the email.

- Your email is now verified and ready to use.

Below is a quick reference table for common email providers:

| Email Provider | Website | Sign Up Button |

|---|---|---|

| Gmail | mail.google.com | Sign Up |

| Yahoo Mail | mail.yahoo.com | Create Account |

| Outlook | outlook.live.com | Sign Up |

Credit: edu.gcfglobal.org

Personalizing Your Email Settings

Creating a new email address is just the beginning. Personalizing your email settings ensures a seamless experience. You can make it easier to use and more enjoyable. Let’s explore how you can personalize it.

Choosing A User-friendly Email Address

Your email address should be simple and easy to remember. Avoid long or complex names. Instead, use your name or a short phrase. This helps others find you easily.

- Keep it short and simple.

- Use your name or initials.

- Avoid numbers and special characters.

Here are some examples:

| Good Examples | Bad Examples |

|---|---|

| [email protected] | [email protected] |

| [email protected] | [email protected] |

Customizing Your Inbox Layout

A well-organized inbox helps you manage emails better. Customize your inbox layout to suit your needs. Most email services offer various layout options.

- Open your email settings.

- Look for “Inbox Layout” or similar settings.

- Choose a layout that works for you.

Here are some layout options:

- Default view: Standard layout with all emails in one place.

- Priority view: Important emails at the top.

- Custom view: Organize emails by categories or labels.

Experiment with different layouts. Find the one that makes you most productive.

Understanding Email Security

Creating a new email address is easy. But, understanding email security is crucial. Email security keeps your information safe from hackers and threats. Let’s explore how to secure your email.

Creating A Strong Password

Your password protects your email account. A weak password can be easily guessed. To create a strong password, follow these tips:

- Use at least 12 characters.

- Include numbers, symbols, and both uppercase and lowercase letters.

- Avoid common words or easily guessable information.

Here are some examples:

| Weak Password | Strong Password |

|---|---|

| password123 | Tr0ub4dor&3 |

| qwerty | 5N!pL3x#1a |

Setting Up Two-factor Authentication

Two-factor authentication (2FA) adds an extra layer of security. It requires you to verify your identity in two ways:

- Something you know, like your password.

- Something you have, like your phone.

Here’s how to set it up:

- Go to your email account settings.

- Find the security or two-factor authentication section.

- Follow the instructions to link your phone.

- Verify the setup with a code sent to your phone.

Now, even if someone gets your password, they can’t access your account without your phone.

Credit: support.titan.email

Managing Email Contacts And Groups

Managing your email contacts and groups can simplify communication. This helps you stay organized. You can easily import contacts and create groups. This section will guide you.

Importing Contacts

Importing contacts can save you time. You don’t have to manually enter each one. Follow these steps to import your contacts:

- Open your email account.

- Go to the contacts or address book section.

- Look for an option to import contacts.

- Choose the file with your contacts. This is often a .csv or .vcf file.

- Upload the file.

- Review the imported contacts for accuracy.

That’s it! Your contacts are now in your email account.

Organizing Contacts Into Groups

Organizing contacts into groups makes sending group emails easier. You can create groups for family, friends, or work. Here’s how to organize your contacts into groups:

- Go to your contacts or address book section.

- Select the contacts you want to group.

- Look for an option to create or add to a group.

- Name the group, like “Family” or “Work”.

- Add the selected contacts to this group.

Now, you can send emails to the whole group with one click. This saves time and ensures everyone gets the message.

Email Etiquette And Best Practices

Creating a new email address is just the beginning. Knowing how to use it properly is key. Email etiquette and best practices ensure your emails are professional and secure. They help you make a good impression and protect your information.

Writing Professional Emails

Writing professional emails requires attention to detail. Here are some tips to follow:

- Use a clear subject line: Make it clear what your email is about.

- Start with a greeting: Use “Dear” or “Hello” followed by the person’s name.

- Be concise: Keep your message short and to the point.

- Use proper grammar: Avoid slang and use complete sentences.

- End with a closing: Use “Best regards” or “Sincerely” followed by your name.

Avoiding Spam And Phishing

Spam and phishing emails are dangerous. They can steal your information. Follow these practices to stay safe:

- Do not open unknown attachments: They may contain viruses.

- Check the sender’s email address: Make sure it is legitimate.

- Do not click on suspicious links: They can lead to fake websites.

- Use a spam filter: Many email services offer this feature.

- Report phishing attempts: Most email providers have a way to report these.

Following these guidelines will help you use your email effectively and safely.

Troubleshooting Common Email Issues

Creating a new email address is easy. But sometimes, users face issues. This guide helps you solve common email problems. Below are solutions for frequent email troubles.

Recovering A Forgotten Password

Forgetting your email password is common. Here are steps to recover it:

- Go to the email provider’s login page.

- Click on the “Forgot Password” link.

- Enter your email address.

- Check your inbox for a password reset link.

- Click the link and follow the instructions.

- Create a new strong password.

Use a mix of letters, numbers, and symbols for a strong password. Write it down somewhere safe. This helps you avoid forgetting it again.

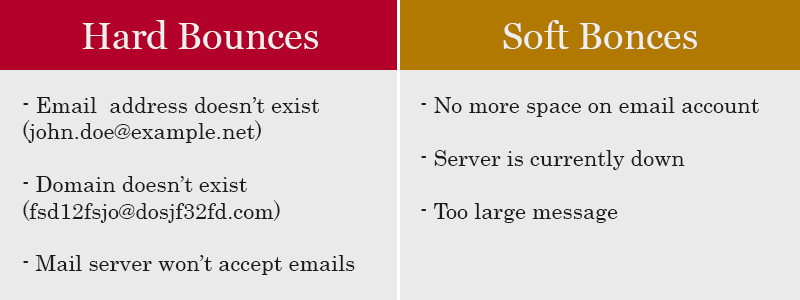

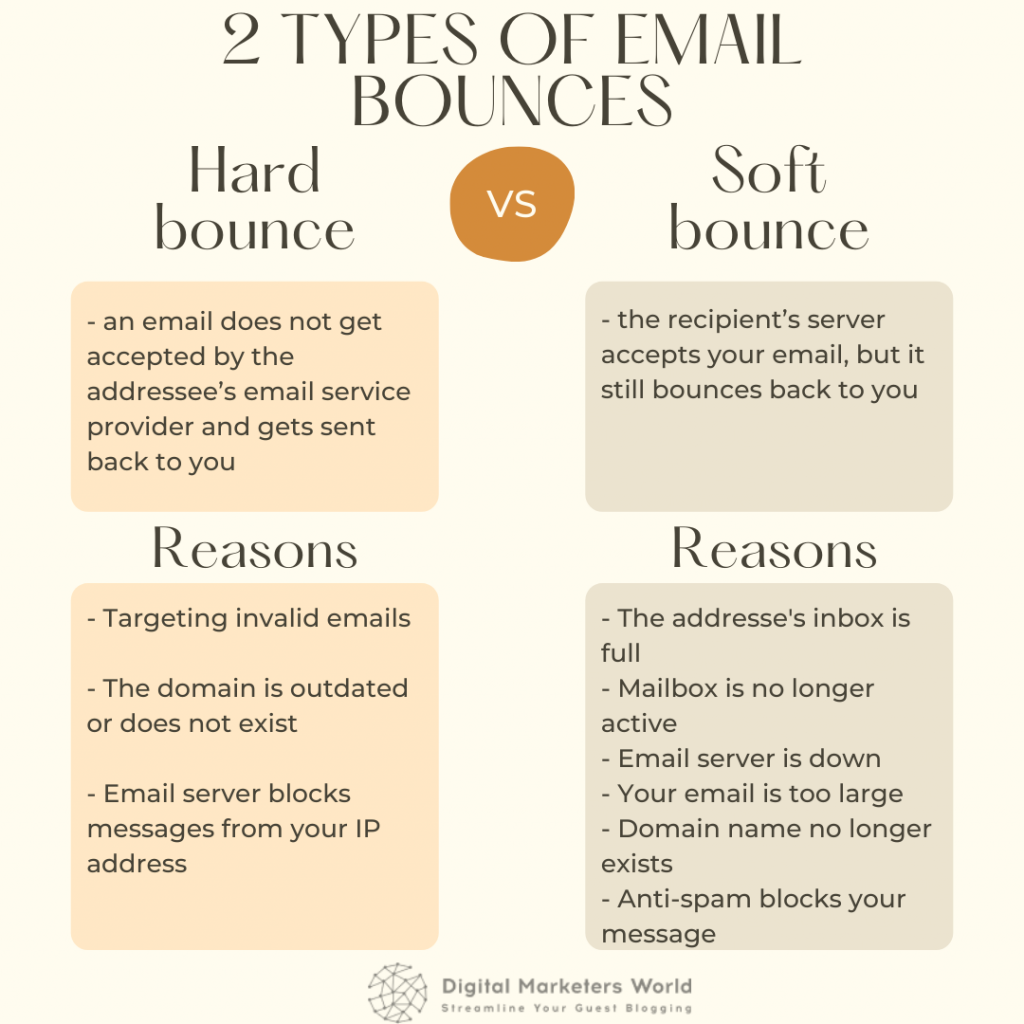

Dealing With Undelivered Messages

Sometimes emails don’t get delivered. Here are common reasons and solutions:

| Issue | Solution |

|---|---|

| Incorrect email address | Check and correct the email address. |

| Full inbox | Ask the recipient to clear their inbox. |

| Spam filter | Check the spam or junk folder. |

Double-check the recipient’s email address. Make sure your message is not too large. If it is, try sending smaller parts.

Next Steps After Email Creation

Creating a new email address is just the beginning. Next, you need to take steps to manage and use your new email effectively. Here are some essential steps you should follow:

Linking To Other Online Services

Once you have your new email, link it to your other accounts. This will help you stay connected and receive important notifications.

- Connect your email to social media accounts like Facebook and Twitter.

- Link it to your online banking for alerts and updates.

- Use it for e-commerce sites like Amazon and eBay.

Linking your email to these services is easy. Just go to the account settings of each service and add your new email address.

Regular Maintenance And Cleanup

Regular maintenance of your email inbox is crucial. It helps you stay organized and ensures you do not miss important emails.

- Check your email daily to stay updated.

- Delete spam and unwanted emails regularly.

- Create folders to organize your emails by category.

- Unsubscribe from newsletters and promotions you do not need.

Maintaining your email inbox will save you time and keep your inbox clutter-free.

Credit: www.wikihow.com

Frequently Asked Questions

How Do I Create Another Email Address?

To create another email address, sign up on an email provider’s website. Fill out the registration form with your details. Verify your identity through the provided method. Follow the instructions to complete the setup. Start using your new email.

How Do I Set Up A New Email Address For Free?

To set up a free email address, visit Gmail, Yahoo, or Outlook websites. Click “Sign Up” or “Create Account. ” Fill in your details, follow the prompts, and submit. Access your new email via the login page.

How Do I Create A New Gmail Email Address?

To create a new Gmail address, visit Gmail. com, click “Create account”, and follow the prompts. Fill in your details, set a password, and verify your phone number.

How Can I Create a New Account Email?

To create a new email account, visit the email provider’s website. Click “Sign Up” or “Create Account. ” Fill in the required information, choose a username and password, then follow the prompts to complete registration. Verify your account through a confirmation email.

Conclusion

Creating a new email address is simple and essential. Follow our step-by-step guide for a smooth process. Ensure you choose a secure password and unique username. Regularly update your security settings. Now you can easily manage communications and stay connected.

Start today and enjoy the benefits of a new email address.